Story Highlights

- Positive views of banking outweigh negative views, 43% to 30%

- Image in 2017 most positive since 2008 financial crisis

- Other industries have recovered more quickly, more fully

WASHINGTON, D.C. -- The banking industry's image with the American public has climbed to its highest point since the 2008 financial meltdown, with 43% now viewing it positively and 30% negatively. But Americans still view banking less positively than they did in the years leading up to the crisis, when it ranked above the average for other industries Gallup measures.

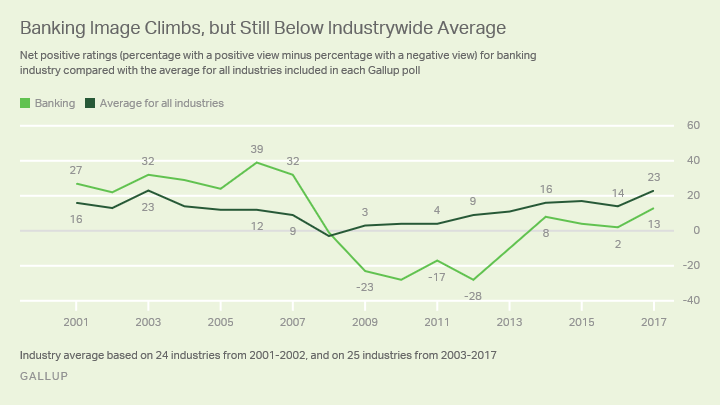

The public's net positive rating of banking -- the percentage with a positive view minus the percentage with a negative view of it -- slid from +32 in 2007 to -23 in 2009, and bottomed out at -28 in 2010 and 2012. This year's +13 rating, an increase of 11 points from 2016, is the industry's highest since 2007. But the current rating is still well below the +29 net positive that banking averaged from 2001 (the first year the question was asked) through 2007.

During that period, the banking industry's net positive rating was higher than Gallup's industrywide average. But since 2009, banking has been below the industry average every year. (Industry averages were based on ratings of 24 industries in 2001 and 2002, and have been based on 25 industries since 2003.)

While Other Industries Have Rebuilt Images, Banking Lags Behind

In contrast to banking, the images of most other major industries that suffered serious damage in the financially tumultuous years from 2008 through 2010 have either regained their pre-recession net positive ratings or surpassed them:

- The oil and gas industry's net positive rating sank as low as -62 in 2006 and -61 in 2008. It is still in negative territory at -2 this year, but that is the closest the industry has yet come to a positive score since Gallup first asked the question in 2001.

- The image of the airline industry also took a hit about 10 years ago, with its net positive rating dropping to -34 in 2008. This year, the industry's net positive rating stands at +6, back at its average for the years 2001-2007.

- The auto industry's net positive ratings plunged from an average of +18 for 2001-2007 down to -35 in 2009. The current rating is its highest ever, +38.

- The real estate industry's net positive rating dropped from an average of +23 from 2001 through 2007 to -40 in 2008. After increasing in each of the last six years, the industry's rating now stands at +34.

Banking's Image Improving Among Middle-Income Americans

Though Americans overall have become more positive in their views of the banking industry during the past two years, views of upper-income Americans have been in negative territory, with a -7 net positive rating in 2016-2017. Offsetting the upper-income negativity, net positive ratings among middle-income Americans have made impressive gains, from -4 in 2014-2015 to +20 for the last two years, while the views of those with lower incomes have stayed roughly the same.

| 2001-2007 | 2008-2013 | 2014-2015 | 2016-2017 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Less than $30,000 | 35 | -3 | 18 | 14 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $30,000-$74,999 | 27 | -16 | -4 | 20 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $75,000+ | 28 | -38 | 4 | -7 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gallup | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Before the 2008 financial crisis, middle-income Americans' views of the banking industry were similar to those of upper-income Americans. In the years immediately afterward, upper-income Americans turned sour on banking to a far greater extent than did those with lower incomes; and in 2016-2017, the middle-income group continues to be significantly more positive about the industry than those with higher incomes.

Implications

As the U.S. moves far into the second decade of the 21st century, new challenges constantly arise for all industries, and banking is no exception. The industry is wrestling with the problem of engaging millennials. It has been under political attack from prominent Democrats. It has been hit with major scandals. Perhaps most importantly, Americans who are likely to have the most money to invest with banks have the lowest opinions of the industry.

Because they have more income to invest, upper-income Americans have more reason to follow news about banking scandals and political attacks on big banks. The industry's ability to respond to such attacks and to avoid major scandals in the foreseeable future could go a long way toward determining whether wealthier Americans, and Americans in general, will once again view banking in the U.S. as positively as they did a decade ago.

Predict business outcomes and build a data-driven culture.

Gallup's advanced analytics services help you harness the power of data.