Story Highlights

- 32% of investors worry about elder financial abuse

- One in three investors know a victim of elder financial abuse

- Among those who know a victim, 51% worry about such abuse

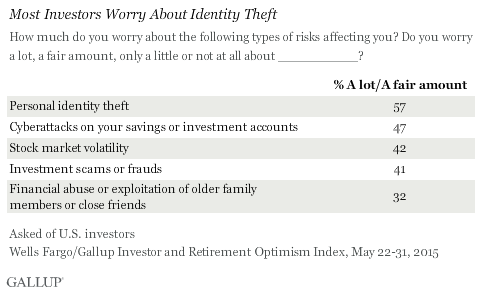

WASHINGTON, D.C. -- Roughly one in three U.S. investors, 32%, say they worry "a lot" or "a fair amount" about the financial abuse or exploitation of older family members or close friends. Although this represents a sizable number of investors, worry about elder abuse ranks below worry about personal identity theft (57%), cyberattacks on their savings or investments (47%), stock market volatility (42%) and investment scams or frauds (41%).

Gallup asked investors how much they worry about these financial threats as part of the Wells Fargo/Gallup Investor and Retirement Optimism Index, conducted May 22-31. The nearly six in 10 investors who worry about identify theft is similar to what Gallup found in 2009, when two in three Americans worried "frequently" or "occasionally" about identity theft. Lower levels of worry about elder financial abuse no doubt reflect that the other threats are more general forms of fraud and financial insecurity, while elder abuse affects a smaller percentage of the population.

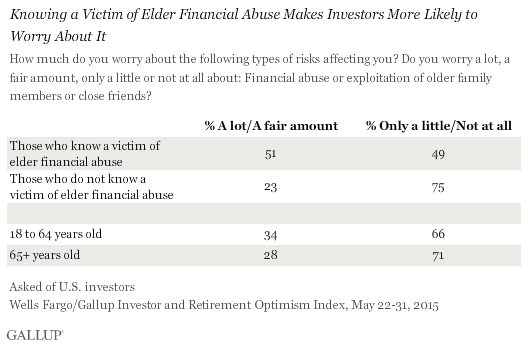

Most Investors Who Know a Victim Worry About Elder Financial Abuse

One in three U.S. investors report personally knowing someone who has been a victim of investment scams or financial abuse targeted at the elderly. These investors who know a victim are more than twice as likely (51%) as those who do not know a victim (23%) to report worrying a lot or a fair amount about elder financial abuse. Investors' age is far less a factor than their personal knowledge of someone who has been victimized in determining how much they worry about elder abuse. Thirty-four percent of investors younger than age 65 are worried, compared with 28% of those 65 and older.

While elder financial abuse may seem a niche threat at the moment, as the American population ages, the crime could affect more people. The American Institute of Certified Public Accountants, for instance, recently reported that almost half of CPA planners have seen an increase in elder fraud or abuse over the past five years. This abuse can take many forms, including phone and Internet scams, the use of deceit to obtain a person's bank account information or dishonest advice on behalf of trusted individuals, such as brokers or even family members.

The elderly are a prime target because they often live alone, have ample financial resources and because some lack familiarity with newer forms of technology. Declining mental capacity, especially among the elderly suffering from dementia or Alzheimer's disease, can also play a factor in elders' susceptibility to financial abuse. The U.S. government has a website specifically designed to help protect elders and their families from elder fraud and financial exploitation.

Majority of Investors Unlikely to Use Adviser to Prevent Elder Fraud

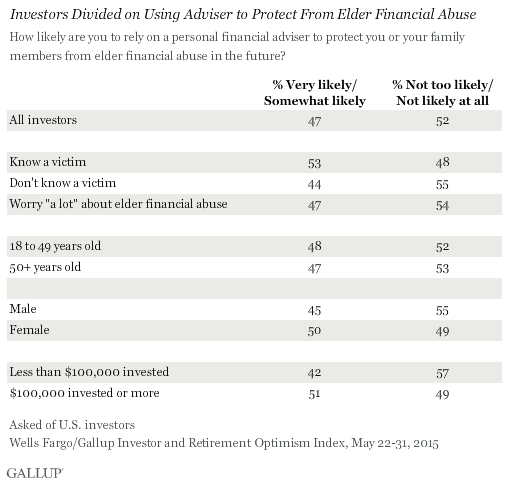

Almost half of investors (47%) say they are likely to rely on a personal financial adviser to protect themselves or their family members from elder financial abuse in the future.

There are no significant differences across gender, age or investment-level groups in investors' intention to seek advice to help prevent elder abuse for themselves or a loved one.

Bottom Line

Elder abuse is not a top concern of investors among several types of potential financial threats they might face, but remains important to about a third of all investors. Similarly, a third of investors personally know an older person who has been financially victimized. Among those who do, about as many are concerned about this form of abuse as are worried about identify theft among investors generally, the top-ranking financial concern. Having a trusted financial professional who can advise investors on major financial decisions or even monitor accounts is one way to avoid being victimized, or to protect loved ones. While close to half of investors are inclined to seek such help in the future, this may depend more on investors' general proclivity to seek advice than on their personal experience with elder fraud.

Survey Methods

Results for the Wells Fargo/Gallup Investor and Retirement Optimism Index survey are based on questions asked May 22-31, 2015, of a random sample of 474 U.S. adults having investable assets of $10,000 or more. For this survey, investors are defined as U.S. adults who have at least $10,000 invested in stocks, bonds or mutual funds, or in a self-directed IRA or 401(k). For results based on the entire sample of investors, the margin of sampling error is ±6 percentage points at the 95% confidence level.

In addition to sampling error, question wording and practical difficulties in conducting surveys can introduce error or bias into the findings of public opinion polls.

Learn more about how the Wells Fargo/Gallup Investor and Retirement Optimism Index works.