Story Highlights

- Six in 10 investors say local housing prices on the rise

- Large, small investors say homeowning an important investment

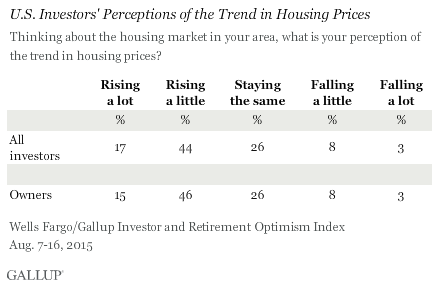

WASHINGTON, D.C. -- Roughly six in 10 U.S. investors say housing prices in their area are rising. Just 11% say prices are falling, while a quarter believe prices are stable.

These data are from the third-quarter Wells Fargo/Gallup Investor and Retirement Optimism Index survey, conducted Aug. 7-16. Investors are defined for this survey as U.S. adults who have at least $10,000 invested in stocks, bonds or mutual funds, a criterion met by 44% of U.S. adults in the current survey. The large majority of these investors own homes (83%) while a much smaller figure rent (15%). In April, Gallup found that most Americans expected local housing prices to increase.

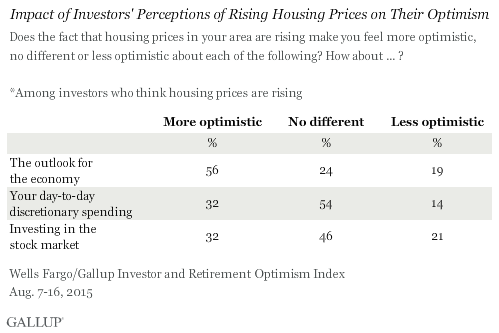

Among all investors who perceive that local housing prices are rising, sentiment is mixed about how increasing prices are affecting their personal financial outlook. About half say rising housing prices make them feel no differently about their discretionary spending or investing in the stock market, while about a third say they are more optimistic about their spending and investments. On the other hand, 56% say rising housing prices make them more optimistic about the economy's outlook, with 24% saying they make no difference.

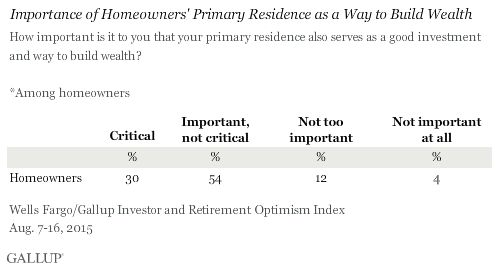

The vast majority of investors who own their homes see owning property as "important" or "critical" to building wealth. Neither the size of one's investments nor an investor's age appears to influence how a home-owning investor values his or her primary residence as a means of building wealth.

Bottom Line

A significant majority of investors of varying ages and portfolio sizes see owning property as a way to build wealth. And most investors perceive that housing prices are going up.

However, few say that these price increases are having a real effect on their own day-to-day spending or investments. Instead, the majority of investors who are seeing housing prices increase in their local market say these increases are making them more optimistic about the outlook for the economy.

These data are available in Gallup Analytics.

Survey Methods

Results for the Wells Fargo/Gallup Investor and Retirement Optimism Index survey are based on questions asked Aug. 7-15, 2015, on the Gallup Daily tracking survey, of a random sample of 509 U.S. adults having investable assets of $10,000 or more.

For results based on the entire sample of investors, the margin of sampling error is ±5 percentage points at the 95% confidence level.

For results based on the 438 investors who own their own home, the margin of sampling error is ±6 percentage points at the 95% confidence level.

In addition to sampling error, question wording and practical difficulties in conducting surveys can introduce error or bias into the findings of public opinion polls.

Learn more about how the Wells Fargo/Gallup Investor and Retirement Optimism Index works.