Many Small Businesses Unaware of Pending EMV Liability Shift

by Coleen McMurray and Frank Newport

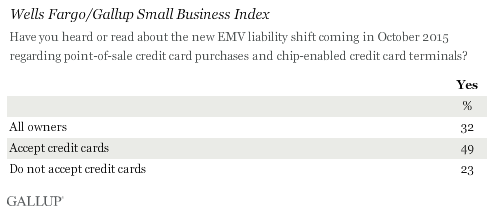

PRINCETON, N.J. -- Despite the serious consequences for small-business owners if they don't follow new rules that take effect this fall for credit cards, the latest Wells Fargo/Gallup Small Business Index survey finds that only 32% of owners are aware of the pending changes.

The new set of credit card liability rules for businesses will take effect in October. These rules specify that businesses that do not upgrade to credit card equipment that can read new, chip-enabled credit cards will be liable for fraud and security breaches.

One of the reasons for the small-business owners' low awareness of the pending "EMV" rules (which stands for Europay, MasterCard and Visa) is that only 35% of owners in the current Wells Fargo/Gallup Small Business Index, conducted July 6-10, report that they accept point-of-sale credit card payments for purchases. Awareness of the EMV mandate is higher among this group than among those who do not accept such payments, as would be expected, but even among those who accept credit cards, awareness is 49%, compared with 23% among those who do not. Thus, about half of small-business owners who accept credit cards are not aware of the major changes forthcoming this fall.

It appears that a majority of small-business owners who accept credit cards but who do not have chip-enabled technology -- about seven in 10 -- are, at this point, in no rush to comply with the mandate; 29% plan to comply by October, while the majority plan to comply either at a later time (34%) or do not plan to upgrade their systems to comply (21%).

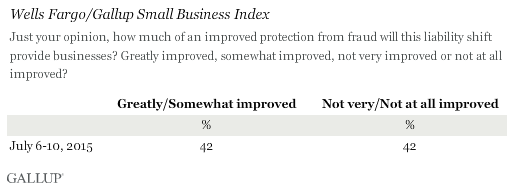

All small-business owners were asked if they believe this liability shift will provide improved protection from fraud -- the shift's major objective. Small-business owners are divided in their opinions -- 42% believe it will greatly or somewhat improve protection, and 42% believe it will improve protection not very much or not at all.

U.S. Small-Business Owners' Optimism Trends Down

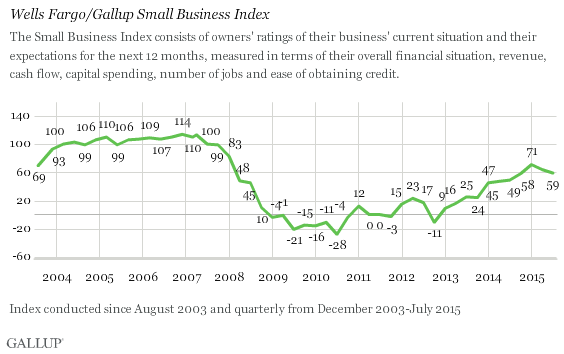

U.S. small-business owners continued to be less positive about the economic

health of their companies in the third quarter. Optimism declined modestly

for the second consecutive quarter this year following a significant jump

at the end of 2014 and in early 2015.

The overall index score, which measures small-business owners' views of the economic condition of their companies, is now at 59, down from 71 in the first quarter and 64 in the second. The last time the index saw two consecutive declines was in the third and fourth quarters of 2012. Despite the drop in the current quarter, the index score is still considerably higher than it was in the third quarter of 2014 (49) and in the third quarter of 2013 (25).

Several factors may have contributed to the decrease in optimism this quarter:

- Two consecutive drops in small-business owners' positive reports of revenue. In the July survey, 39% of small-business owners reported that their company's revenues increased over the past 12 months, down significantly from 49% in January.

- Slight declines in reports of capital spending. Fewer small-business owners, 25%, plan to increase capital spending in the next 12 months than said the same in April (29%).

Survey Methods

Results are based on telephone interviews with 600 U.S. small-business owners in all 50 states, conducted July 6-10, 2015. The margin of sampling error is ±4 percentage points at the 95% confidence level.

For more information about Wells Fargo Works for Small Business, visit WellsFargoWorks.com. Follow us on Twitter @WellsFargoWorks.

Learn more about how the Wells Fargo/Gallup Small Business Index works.